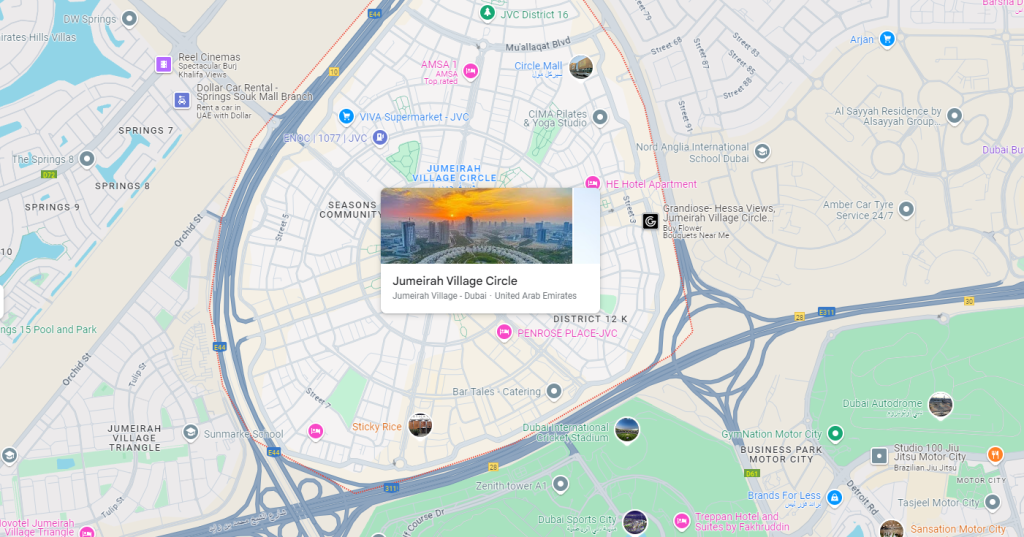

Jumeirah Village Circle: Best Area to Invest in Dubai Real Estate

Jumeirah Village Circle (JVC) is a community that offers a blend of comfort and convenience.

Located in the heart of Dubai, JVC provides easy access to major highways and is designed for families looking to escape the city’s hustle while still enjoying urban amenities.

With more than 2,800 villas and over 3,100 townhouses, there are plenty of options for anyone seeking a home or an investment in JVC.

The community also includes gyms and running tracks, making it easy to maintain a healthy lifestyle right at your doorstep.

Whether you want to relax in a park or explore the nearby urban attractions, JVC has something for everyone.

Transportation is convenient, with the J01 bus connecting JVC to key areas in Dubai.

Even though there isn’t a metro station within the community, you can rely on this bus service to travel through the city easily.

How to Get a UAE Golden Visa for International Investors

The UAE Golden Visa by property investment offers a unique opportunity for those looking to establish a long-term presence in one of the world’s most established economies.

You can obtain residency in the UAE by investing in real estate worth at least AED 2,000,000, which allows you to enjoy various benefits, including access to healthcare and education.

This program is particularly attractive due to Dubai’s strong real estate market and the lifestyle it offers.

Investing in property not only grants residency but can also be a pathway to becoming a citizen.

Many potential investors are drawn to the idea of securing a future in the UAE, where the environment is welcoming and the economy is thriving.

This article covers everything from getting a UAE investory visa for 10 years, 5 years to renewal and cancellation of your residency visa in UAE.

Fixed Asset Depreciation Rate in UAE for Real Estate

Understanding fixed asset depreciation for real estate in the UAE is crucial for property investors and owners.

The depreciation rate for real estate assets generally ranges between 2.5% and 5% per year, depending on the specific asset type and its usage.

UAE accounting standards outline various methods for calculating depreciation, such as straight-line and declining balance methods, providing flexibility in how you manage your investments.

It’s important to be aware that these depreciation calculations can affect your overall tax liabilities, impacting your financial planning.

By grasping these concepts, you position yourself to optimize your returns while complying with the local regulations.